Get This Report on Pvm Accounting

Table of ContentsSome Known Questions About Pvm Accounting.Fascination About Pvm AccountingGet This Report on Pvm AccountingAll about Pvm AccountingPvm Accounting Things To Know Before You Get ThisThe smart Trick of Pvm Accounting That Nobody is Discussing

Guarantee that the accountancy procedure abides with the legislation. Apply required building and construction accountancy standards and procedures to the recording and coverage of construction task.Communicate with various financing agencies (i.e. Title Company, Escrow Business) pertaining to the pay application process and demands required for payment. Assist with carrying out and keeping internal monetary controls and procedures.

The above declarations are planned to describe the general nature and level of job being executed by individuals designated to this classification. They are not to be taken as an extensive checklist of obligations, obligations, and skills required. Personnel may be needed to do obligations beyond their regular duties once in a while, as required.

The Best Guide To Pvm Accounting

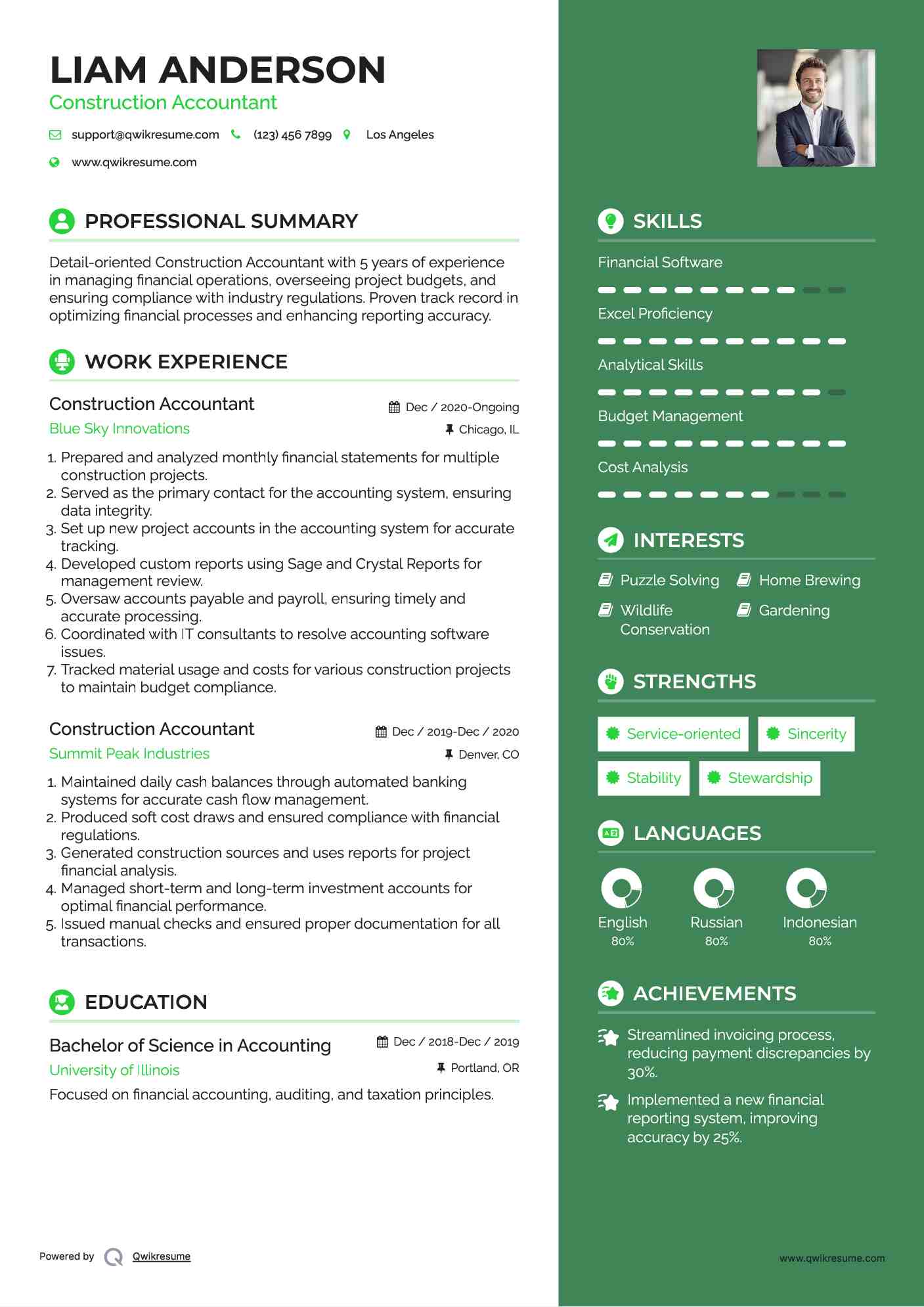

Accel is seeking a Building and construction Accountant for the Chicago Office. The Construction Accounting professional performs a selection of bookkeeping, insurance conformity, and project management.

Principal responsibilities consist of, however are not limited to, managing all accounting functions of the business in a timely and precise manner and supplying reports and schedules to the business's CPA Company in the prep work of all financial declarations. Ensures that all accountancy procedures and features are managed properly. In charge of all monetary documents, pay-roll, banking and daily operation of the audit function.

Prepares bi-weekly test balance reports. Works with Job Supervisors to prepare and publish all regular monthly billings. Procedures and concerns all accounts payable and subcontractor settlements. Creates monthly recaps for Workers Payment and General Obligation insurance premiums. Generates monthly Job Cost to Date reports and dealing with PMs to resolve with Task Supervisors' spending plans for each project.

More About Pvm Accounting

Efficiency in Sage 300 Building and Real Estate (previously Sage Timberline Workplace) and Procore construction management software an and also. https://dzone.com/users/5145168/pvmaccount1ng.html. Have to additionally be proficient in various other computer software systems for the prep work of reports, spreadsheets and other bookkeeping evaluation that may be needed by administration. construction accounting. Have to possess solid organizational skills and capacity to prioritize

They are the economic custodians who make certain that building and construction projects continue to be on budget plan, follow tax laws, and preserve financial transparency. Building and construction accountants are not simply number crunchers; they are tactical companions in the construction procedure. Their primary function is to take care of the monetary facets of building tasks, making certain that resources are designated efficiently and monetary risks are minimized.

Fascination About Pvm Accounting

By maintaining a tight grasp on task funds, accounting professionals aid protect against overspending and financial obstacles. Budgeting is a cornerstone of successful construction tasks, and building and construction accounting professionals are crucial in this regard.

Browsing the facility web of tax laws in the construction sector can be tough. Building accountants are fluent in these policies and ensure that the job follows all tax needs. This consists of handling payroll tax obligations, sales tax obligations, and any various other tax obligation obligations specific to building and construction. To excel in the role of reference a building accountant, individuals require a strong academic foundation in accounting and money.

Additionally, qualifications such as State-licensed accountant (CPA) or Licensed Construction Sector Financial Specialist (CCIFP) are very related to in the sector. Working as an accountant in the building and construction industry includes an one-of-a-kind set of difficulties. Building and construction projects commonly involve tight due dates, transforming policies, and unforeseen expenditures. Accountants should adapt swiftly to these obstacles to keep the task's monetary wellness intact.

Pvm Accounting for Dummies

Ans: Building accountants create and monitor budgets, recognizing cost-saving possibilities and making certain that the job stays within budget. Ans: Yes, construction accountants take care of tax obligation compliance for construction projects.

Introduction to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make difficult options among numerous monetary options, like bidding on one project over an additional, choosing financing for products or devices, or establishing a project's earnings margin. In addition to that, building is a notoriously unstable industry with a high failing rate, slow-moving time to repayment, and inconsistent capital.

Production entails duplicated processes with easily recognizable expenses. Production calls for different procedures, products, and equipment with varying prices. Each task takes location in a new place with varying website conditions and one-of-a-kind difficulties.

The Greatest Guide To Pvm Accounting

Long-lasting connections with vendors alleviate arrangements and improve performance. Irregular. Regular usage of different specialized contractors and vendors influences efficiency and capital. No retainage. Repayment shows up completely or with routine payments for the full agreement quantity. Retainage. Some section of payment may be held back until job conclusion also when the contractor's work is completed.

Routine manufacturing and temporary agreements cause convenient capital cycles. Irregular. Retainage, slow payments, and high upfront prices bring about long, uneven capital cycles - construction accounting. While traditional makers have the advantage of controlled environments and optimized production procedures, building and construction firms need to constantly adapt per brand-new job. Even rather repeatable tasks require modifications due to website conditions and other variables.

Comments on “The Only Guide for Pvm Accounting”